Don’t let Christmas Blow Your Budget!

It is so easy in the holiday bustle to get wrapped up with spending on everything from decorations, to food, travel, and of course gifts. It is wonderful feeling to be able to give a gift that makes someone light up and know you found something special that they wanted. It is nice to give tokens of appreciation to the people in our lives but it is also easy to go overboard, especially if you don’t have a plan.

Start with a list of family and friends that you are closest to and have a budgeted amount for each person. Use the All Cash Christmas form to get started Cash Christmas. When you shop take your planned envelope of cash and keep the list of what you are looking for handy. Consider also where you can find the item you are looking for what are options and solutions that minimize the running you have to do. I hate the mall, not just for the crazy parking issues but for the side tracking and budget blowing opportunities that happen when I’m there. I am a huge fan of Half Price Books, craft fairs, and church bazaars as they have all sort of fun and unique things for the season. Amazon is great for targeted shopping and showing you what is in your cart and how much you have spent.

A new type of list!

This year we are trying a new “list” technique – I sent out the following text to my niece, nephew and assorted family: What is something you want, something you need, something to wear, and something to read. All four questions need to be completed or your list will be considered void. My nephew wasn’t too sure but it wasn’t long before I started getting texts back. The reading seemed to stump them the most but I know it will catch on eventually.

DIY Approach

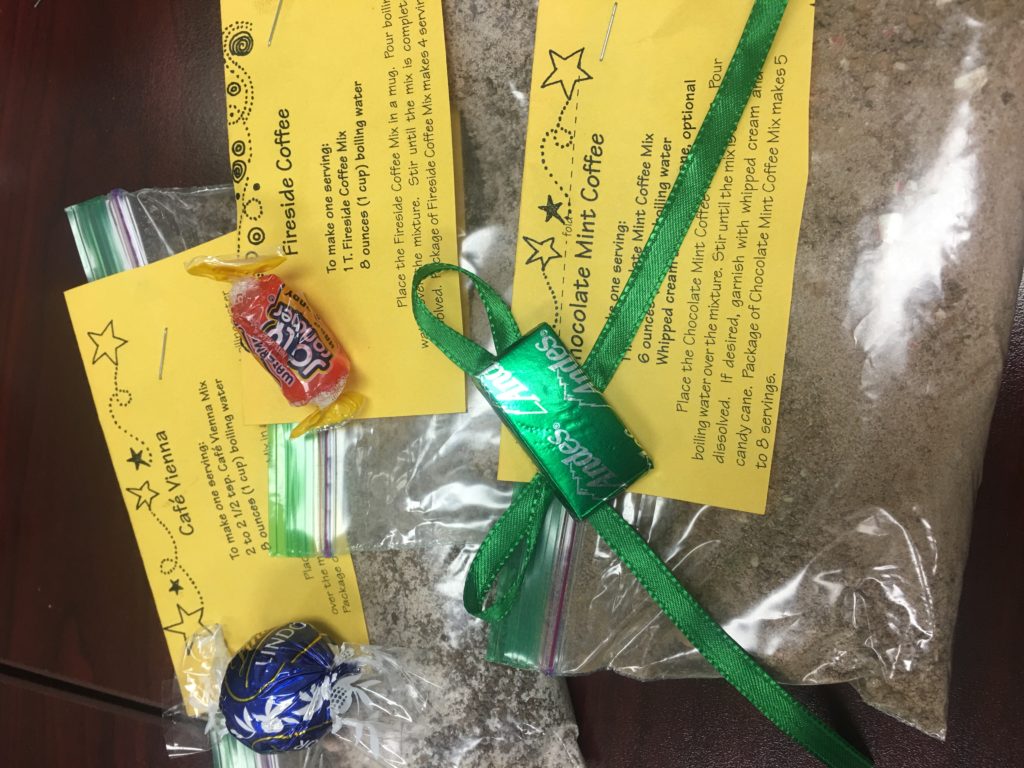

Another idea to consider is making gifts. Teaching Financial Peace University and being a Ramsey Preferred Coach puts lots of special people in my life that I want to do something for so I started making hot teas and coffees. I found the recipes (At Half Price Books) and found many of the ingredients in my pantry. I have found great joy this season listening to Christmas music, mixing up the ingredients and creating fun tags with ribbons. I have made almost 50 little bags for less than $40 and by mixing and matching the bags and adding cups for the family found a unique and fun way to send a bit of cheer to all my families.

Don’t start the New Year with a Christmas Debt Hangover. According to CreditKarma over a quarter of American’s plan to go into debt this season and one in ten plan to take out a loan! Dire predictions have said that 61% of American’s are willing to add to their debt deficit this holiday season. The average American who celebrates Christmas plans to spend over $500 on meals, gifts, and travel. This debt is then linked to stress and money fights. The other statistic is that almost half – 43% feel that holiday debt is unavoidable. This just makes no sense. Make a budget stick to it Christmas is not a surprise it should be a sinking fund in your budget.

Don’t start 2020 with a debt hangover!

The final reminder is set clear expectations with your family. Gifts may not be a blessing if they feel a need to reciprocate at the same level and do not have the same resources. Consider drawing names, setting an acceptable limit for spending, or just give to the children and not every member of the family. Do whatever is best for your family by being honest and open.

Call to Action

What works for you and helps your family stay in budget? Please share your ideas.